If you’ve been thinking about installing replacement windows, now’s a great time to finally do it. That’s because there are some new tax credits that can help you save money on home improvement costs.

Replacement windows are a significant investment for your home, so it stands to reason that you want to save money wherever you can. Not only will you save cash on your energy bills with more efficient windows, you’ll save money with immediate tax credits that pay you back instantly.

Unlike former tax credit programs, the new one under the recently-enacted Inflation Reduction Act features transferrable credits for consumer purchases. What does this mean? Instead of paying the full price of windows up front and claiming the credit come tax return time, now you can transfer the credit to another company (such as the installer or manufacturer, or a financing company) to receive an immediate discount. Not only does this immediate discount drive sales, it offers consumers real-time incentives to tackle green improvements.

About The Tax Credit

The Inflation Reduction Act results in federal tax credits for up to 30 percent of the costs associated with energy-efficient home improvements. When you consider the old credit was just 10 percent, this is a pretty good deal.

For window and skylight replacement in particular, you get up to $600, and if you want to replace doors while you’re at it, the tax credit for door replacement is up to $500. You can even get a credit up to $150 for home energy audits and $1600 for weatherization initiatives such as insulation and sealing.

This is great news for home owners who have been dreaming about making necessary green improvements but just haven’t had the incentive or cash to do it. These tax credits will increase from a one-time credit of $500 to a yearly credit of $1,200, meaning you don’t have to cram all your improvements into one calendar year. You can spread them out.

The Inflation Reduction Act, signed into law by President Biden back in August, allocates $370 billion overall to combat climate change. A portion of that total is in the form of rebates and tax credits, with the goal to help people save thousands when investing in energy-efficient windows and doors as well as other green projects like electric vehicles or insulation.

If you are a home owner that earns between 80 percent and 150 percent of your area’s median income, you could get 50 percent of the total window replacement project cost – up to individual limits and up to $14,000 in total. If you make less than 80 percent of the area’s median income, you can recoup 100 percent of the cost.

There’s never been a better time to take advantage of these generous tax credits. In fact, adding replacement windows can lower household energy bills by 12 percent or more, according to Energy Star.

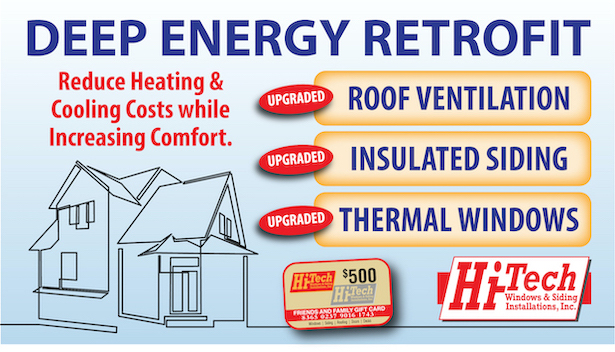

Contact Hi-Tech Windows & Siding for Replacement Windows

If you’re ready to schedule an appointment for window replacement in Methuen and beyond, call us today at 800-851-0900 to book your consultation and get a free quote.